By Ally Lanasa, Staff Writer

(Feb. 11, 2021) The Berlin Mayor and Council reviewed the general fund and utility funds report with the FY20 second quarter update of revenues and expenditures against the FY21 budget from Natalie Saleh, the town’s finance director.

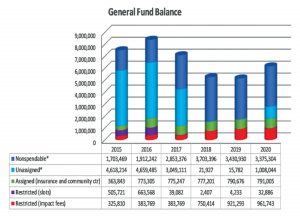

The general fund balance consists of non-spendable fund balance, restricted fund balance, committed fund balance, assigned fund balance and unassigned fund balance.

“Committed and assigned, they’re very similar to each other, and they have a specific purpose,” Saleh explained. “Unassigned is pretty much the spendable balance, what’s left at the end of the year as of fiscal year [June 30] after all the expenses have been paid.”

CHART COURTESY NATALIE SALEH

The Berlin Mayor and Council reviewed the FY21 general fund balance in comparison to the general fund balance over the past five fiscal years. The general fund balance consists of non-spendable fund balance, restricted fund balance, committed fund balance, assigned fund balance and unassigned fund balance.

Town Administrator Jeff Fleetwood explained that the numbers in the presentation were as of June 30, 2020. After June 30, the Town Council agreed to reduce the non-spendable fund balance by half, which is not shown. It will be reflected in FY21.

The total general fund ending FY20 was $6,168,192 with $3.4 million in non-spendable fund balance, $995,000 in restricted fund balance, $791,000 in assigned fund balance, and $1 million in unassigned fund balance.

Saleh then informed the council of the general fund revenues and expenditures over six months, showing the actual versus the budgeted amount.

For 2021, the town budgeted $6.2 million in revenues, but from July to December in FY21, the town has only received $4.7 million. For the remainder of FY21, 24 percent of revenues remain to be collected, Saleh said.

For expenditures, the town budgeted $6.6 million for FY21, and from July to December in FY21 the town expended $3 million for a difference of 53 percent.

“With that said, on the bottom we have several transfers as well as advancement from the impact fees for the street projects to show that we are running on a balanced budget,” Saleh said.

As of Dec. 31, 2020, general fund revenues exceed expenditures by $1.6 million.

The largest source of revenue for the general fund is taxes. Other sources include service charges, licenses and permits, impact fees, grants, and interest income.

As of December, the town has collected $3.3 million in taxes of $4.2 budgeted.

The town budgeted $186,500 in revenue from licenses and permits and has collected almost $80,000 as of December.

Grants, including highway user revenue, state police aid, main street tourism, slot revenue, façade grant and parks and recreation grant, totaled $194,000 as of December, which is a 59 percent difference from what was budgeted.

Saleh noted that the parks and recreation grant for $107,500 was not received by December.

Saleh said the Worcester County grant is normally $465,000 each year. The town received $636,000, which included the coronavirus relief grant.

Service charges, such as parking fines, waste collection, site plan review and grass cutting, were budgeted for $835,000. The town has received about half of those charges during six months.

As for impact fees for residential and commercial, the town has only obtained $4,000 of the $30,000 budgeted.

“I’m hoping we will catch up by the end of the year,” Saleh said.

The town has earned $23,000 in interest while conservatively only budgeting $10,000.

Lastly, the miscellaneous income totaled $3,600 by December with $5,000 budgeted.

“I think we will succeed by the end of the year to collect all the revenues,” Saleh added.

Fleetwood said new residential and commercial construction in Berlin like the Willows at Berlin and Oceans East will increase revenue as well soon.

CHART COURTESY NATALIE SALEH

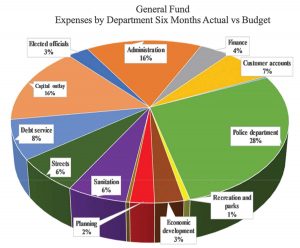

The Berlin Police Department and administration department have the largest expenses by department of the general fund from July to December 2020.

As for the town’s general fund expenditures, the police department, capital outlay and administration are the largest expenses.

“Overall, if we look at the differences of each department, we’re on a good pattern of either at 50 percent or a little bit more to expend, which we should expect that to be at the six months mark,” Saleh said.

The total expenses by department budgeted for the FY21 budget is $6.6 million and $3 million has been expended between July and December.

The total expenses budgeted for elected officials is $183,000 with almost $90,000 spent by December.

“Administration is a little larger department. We have more personnel included here and also we have fire and EMS allocation line item under the administration,” Saleh said.

The town has spent $493,000 of the $1.3 million budgeted for the administration department, while $129,000 of the $295,000 budgeted for the finance department has been spent.

The customer accounts are usually absorbed by the utility funds, but Saleh showed them as a separate to examines the expenses of the general fund.

“As of right now for six months, we’re at 54 percent, which is right where we need to be,” she said.

For building and grounds, the town budgeted nearly $50,000 and has spent slightly more than $8,000 in the first six months of FY21.

The Berlin Police Department has spent $859,000 of its nearly $1.9 million budget.

“You probably will ask me, ‘Why do we have negative of insurance?’ That was a refund for the vehicle that we submitted to be replaced,” Saleh explained. “The police department will replace that vehicle of that amount, plus the insurance refund will be applied towards the purchase of a new vehicle. That negative will not stay there.”

The recreation and parks department has 70 percent of its budget to spend in the remaining six months of FY21, while the economic development department has 63 percent of its budget.

The planning department has spent $74,000 of its $192,00 budget, and the public works department has spent nearly $12,000 of its $134,000 budget.

Originally, the town budgeted for a public works department head, but that role has not been filled.

The largest expense of the sanitation department is contracted services with $131,000 budgeted for the fiscal year. The total budgeted for the sanitation department is $376,000 with $184,000 spent already.

The town’s streets department has 60 percent of its $515,000 budget remaining.

The debt service for the general fund consists of bond principal and bond interest for an approximate budget of $308,000. Twenty-two percent of the budget remains.

“Some payments are annual, several are quarterly and one is biannual,” Saleh said.

Capital outlay is divided into equipment for administration, police, streets and parks.

The capital outlay gained $268, 262 more than the $219,500 budgeted.

Saleh said the electric fund has operating revenues budgeted at $5.5 million with 60 percent remaining. As for the electric fund’s budgeted $5.5 million operating expenses, the town has spent $2.5 million.

“As of six months for electric, we’re a little bit over expensed or negative in the total, but we have some insurance proceeds,” Saleh said.

The town received $99,000 for the engine being replaced.

Saleh added that collections for the electric fund are behind because of covid restrictions and the weather.

Revenues for the electric fund are the electric service, service charges and miscellaneous funds.

The largest expenses of the electric fund are purchased power and personnel expenses.

The water fund has operating revenues budgeted at $777,250 with 55 percent remaining. As for the water fund’s budgeted $941,000 operating expenses, the town has spent $427,000. The operating income is at a loss currently.

“Then, we have special connection fees, $17,000, which play into the whole fund balance,” Saleh said. “So, as of right now for six months we see a $60,000 operating loss. Hopefully, the revenues will improve, and we will remain watchful for the expenses and the fund will not close on a negative.”

The largest source of revenue for the water fund is water service, while the largest expense is personnel expenses, followed by capital outlay.

The sewer fund has an operating revenue budgeted at $2 million and the town has received slightly more than $1 million by the six-month mark with 48 percent remaining. As for the sewer fund’s budgeted $2.2 million operating expenses, the town has spent $806,000 so far.

“We have special connection fees collected at $47,000 at the six months mark,” she said, adding that the town expects more equivalent dwelling units (EDUs) to come this fiscal year for the local projects.

The largest sewer fund revenue source is sewer service, while the largest expense for the sewer fund is personnel costs, followed by debt service.

“We have 63 percent remaining for the sewer fund expenses,” Saleh said. “Hopefully, this year we will close in green not in red.”

Lastly, the stormwater fund has operating revenues budgeted at $168,650 with 50 percent remaining.

The stormwater fund’s largest expense is personnel costs followed by supplies and operating costs.

The operating expenses are budgeted at $144,000 with 50 percent remaining for the rest of the fiscal year.

Saleh added that there isn’t anything alarming right now about the expenses.

“I’m hoping the water services expenses will remain down, so we can kind of take a breather and say that we closed the year for water fund and sewer fund in good numbers,” she said. “General fund overall is doing great. I am expecting the collections of all the revenues in full and even exceeding.”

Councilman Dean Burrell asked Saleh to add an analysis component when the planned percentages are greater than 10 percent on line items of $100,000 or greater. He also requested that the analyses come from department heads not Saleh.

Then, Councilman Jack Orris asked Saleh to provide more information about general fund transfers.

“The actual transfers are not in place. They’re budgeted as projected on this specific presentation,” Saleh replied. “There is a transfer from sewer fund created with the specification if the sewer fund would be able to meet that transfer by the end of fiscal year as discussed during the budget. Also, there is a small transfer under stormwater fund for $25,000. The same pretty much scenario, if the stormwater will close the year with positive and excess, then that repayment or that transfer will happen. As of right now, there is no transfer, just the budgeted amounts.”