FY22 budget work session to take place on April 12, full schedule posted online

By Ally Lanasa, Staff Writer

(Feb. 25, 2021) The Berlin mayor and Town Council reviewed the general fund budget during their meeting on Monday to prepare for the budget work session on April 12.

“The general fund is the general operating fund of the town,” said Natalie Saleh, the town’s finance director. “The general fund [is] used to account and report all the financial resources not accounted for and reported in other funds. It includes all transactions for general government services.”

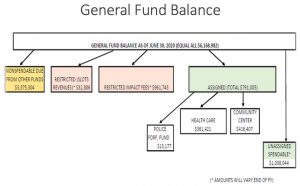

CHART COURTESY NATALIE SALEH

This FY20 general fund balance chart demonstrates the total of each component that represent the “spendability” of the fund balance as of June 30, 2020. Since then, the Berlin Town Council agreed to reduce the interfund transfer due from the sewer fund to the stormwater fund in the non-spendable fund balance to $1.7 million in FY21.

Revenues of the general fund are mostly derived from taxes, grants and licenses and permit fees.

Saleh said the resources generated by the fund are spent for general government according to the budget approved by the mayor and council every year.

“To manage all that, there is a fund accounting in place and it’s necessary,” she said.

In fiscal year 2020, property taxes made up 59 percent of revenue, intergovernmental revenues made up 16 percent and service charges to other funds made up 12 percent. The total revenue for FY20 was nearly $6.8 million.

As for general fund expenditures, 39 percent of funds went to the Public Safety Department, 26 percent of funds were spent for general government and 16 percent went toward the Public Works Department. The total expenditures in FY20 were approximately $5.8 million.

The net change in the general fund balance, or the revenue total subtracted by the total expenditures, was $1 million in FY20.

Then, Saleh described the general fund balance as assets subtracted by liabilities.

“But we’re not talking about long-term. Here it’s mostly over short-term liabilities and short-term assets,” she said.

Saleh added that people will often perceive the government’s financial health by the fund balance.

“It is true that if the balance is low or if we’re running on a deficit that the town will need some improvement in the financial situation, but having a large fund balance at the end of the year doesn’t mean that it’s great or good because there’s so many components, or layers, of the fund. We should look at and understand what each layer means and what does it do,” she said.

There are five components that represent the “spendability” of the fund balance: the non-spendable fund balance, the restricted fund balance, the committed fund balance, the assigned fund balance and the unassigned fund balance.

Non-spendable amounts are either not in a spendable form, such as inventory or prepaid amounts, or are legally or contractually required to remain in the fund, Saleh explained.

Restricted amounts can only be spent for specific purposes because of restrictions imposed by mayor and council, higher levels of governments or grantors.

Committed amounts can be spent only for specific purposes set by the mayor and council through resolutions or motions to approve, whereas assigned amounts are earmarked by the mayor and council for specific purposes that do not meet the criteria to be classified as restricted or committed amounts.

Lastly, unassigned amounts are available for any purpose and can be reported only in the town’s general fund.

The audited total general fund balance for FY20 was nearly $6.2 million. The non-spendable fund balance made up $3.4 million of the general fund balance with an interfund transfer due from the sewer fund to the stormwater fund. However, the Town Council agreed to reduce that to $1.7 million in FY21.

“Restricted balance consists of slot revenues and the slot revenues have limitations on how monies can be spent, which come from the higher level of the government,” Saleh said. “We also have our own restriction by mayor and council by the ordinance, which is impact fees.”

The restricted fund balance was approximately $995,000 in FY20.

The assigned fund balance, which totaled $791,000, consists of funds for specific purposes assigned by the mayor and council such as healthcare, the police department and the community center.

The unassigned balance at the end of the year was $1 million for spending in the event of unexpected contingencies.

Saleh said the primary reason to maintain a general fund balance is the uncertainty in future funding because of instances like reduction in county and state shared revenues or revenue reductions and losses related to direct programs and fees. The stabilization fund balance could help the latter.

“Stabilization is to prevent the interrupted service that we provide or mitigate the effects of the occasional shortfalls in revenues,” she said.

In addition, the debt reduction fund supports the general fund if it carries the debt.

“In case we have a great reduction in revenue, we need to ensure that the short-term liabilities will be covered,” Saleh said.

Another reason to maintain a general fund balance is contingencies for unanticipated emergencies, such as pandemics, floods and other catastrophes.

“Here we have a disaster recovery fund that could come and help us to be prepared and have some funds that we could start putting in and supporting the short-term services and not to be interrupted,” Saleh said.

Additionally, a capital reserve fund balance can be helpful for periodic large expenditures, including large anticipated capital improvements or emergency capital projects, Saleh said.

Responding to Councilman Jay Knerr, Saleh said the recommended goal for the reserve funds that the town should work toward is a spendable balance of no less than 60 days, but the town can ultimately decide.

“It’s in our discretion to decide if we want to do a little bit better than 60 days, whether we want to be just in the middle or better than that,” she said.

Knerr also asked if the $32,000 in slot revenue is the total after paying the debt service of the police department facility.

“Yes, so monthly amounts coming from slot revenues get basically rolled into the general fund and not set aside until we complete all the capital project amounts and then we can basically set it aside and not spend it,” Saleh replied.

The town has about two and half years left of payments for the police department facility.

“I do just want to clarify for everybody watching at home there is no debt service per say on the police department. It’s not a bond that’s been floated for that project. Those monies were borrowed from the general fund and are being paid back using the slot revenue,” Mayor Zackery Tyndall said.

He added that the FY21 budget shows where the money from slot revenue is expected to go into the reserve fund.

Knerr asked why the previous mayor and Town Council decided to fund the police department facility from the general fund.

“At that moment, the projections were coming in at lower amounts and we had a balance available,” Saleh replied. “In the past, we had a very healthy general fund balance of $8.4 million.”

However, the price for the police department facility was higher than planned.

“The decision by mayor and council at that point was to totally finance that from the reserves of the general fund,” Saleh said.

A reserve policy draft will be presented at the next Town Council meeting on March 8.

Tyndall added that the introduction and first reading of the tax rate will take place on March 8. Then, a public hearing about the tax rate and adoption by the council is scheduled for March 22.

To view the FY22 budget schedule, visit https://berlinmd.gov/wp-content/uploads/2021/01/Town-of-Berlin-Budget-Schedule-FY22.pdf.