By Ally Lanasa, Staff Writer

(March 11, 2021) The Berlin mayor and Town Council reviewed a draft of a general fund reserve policy on Monday night as they set financial goals for the town’s general fund budget.

A draft reserve policy that the mayor and council rejected last year has been improved and made more straightforward. Town Administrator Jeff Fleetwood also told the council, in response to a question from Councilman Jay Knerr, one reason the draft did not pass last year might have been because of how it was presented.

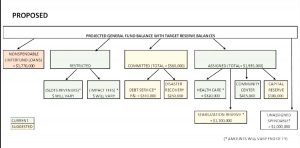

CHART COURTESY NATALIE SALEH

Finance Director Natalie Saleh showed the targeted reserve balances for the projected general fund balance in FY22 during the Berlin Town Council discussion about adopting a reserve policy on Monday night.

Fleetwood and Finance Director Natalie Saleh reminded the council that the reserve policy is a financial guide, not law.

The town has been advised to establish a general fund reserve policy by the Government Finance Officers Association (GFOA) and external auditors PKS & Company, PA.

“I think we need it to improve the resilience of the town. We needed to have it to mitigate the revenue shortfalls and ensure that we can continue the service in case of emergencies or unpredicted situations,” Saleh said.

According to the policy, the town will establish and work to maintain reserve balances to “guard its citizens against service disruptions in the event of economic uncertainties, local disasters, and other financial hardships.”

It also can be used to ensure adequate cash flow when revenues and expenditures fluctuate and to boost bond ratings.

The reserve policy states that the committed fund balance of the general fund should maintain a recommended fund balance for disaster recovery of $250,000 to help mitigate impacts of natural or human made disasters and a recommended fund balance for debt service is equal to one year of the general fund debt service (principal and interest) for any outstanding debt instrument.

For the next fiscal year, approximately $310,000 will be needed for debt service, Saleh said.

As for the assigned fund balance, the recommended fund balance for a stabilization reserve is 20 percent of the current fiscal year’s general fund operating budget, which is roughly $1.1 million, according to Saleh’s diagram. Capital reserve of $100,000 should also be maintained to fund major infrastructure projects and equipment needs of all General Fund departments.

The assigned fund balance should also maintain a recommended fund balance for health insurance of 40 percent of the average of the last three years of health care premiums. Currently, the assigned fund balance has $320,000 for healthcare as well as $415,000 for the community center.

“If we decide to use any of the monies or move from one assigned balance to committed, that would be also always discussed by mayor and council and approved by and we would report the balances during the budget. I would present the balances and recommend the levels,” Saleh said.

Were a catastrophic event to occur, money set aside for use in those circumstances could be transferred to the requisite department, although it must be reported to the mayor and council at the next public meeting within 30 days.

“I would like to see a number. I would like to see a number that would be the number for all categories and that number divided as Natalie has indicated in her spreadsheet or in her diagram,” said Councilman Dean Burrell.

I would also like to see a number associated even with those items that have percentages and a provision in this document related to the evaluation and update of those percentages. I think this document needs to be a standing document. It needs to be a document that changes a little.”

Fleetwood explained that the total amounts of the committed and the assigned fund balances were included in Saleh’s diagram, but the restricted fund balance will vary.

Burrell asked if the council needs to have a provision to update those numbers in the reserve policy, to which Saleh said yes.

“With the updates and reporting, which is on the last page [of the policy], you would receive the actual numbers where we would stand. So, I can present that in the same format, which you see on the screen … or it could be in any format that you would like to see,” Saleh replied.

Those numbers will be presented during the annual budget adoption process and audit presentation.

“So, we will present them to you as an attachment, but the policy itself as the body is actual guidelines for how we should come up to those balances,” Saleh told Burrell.

Councilman Troy Purnell asked Mayor Zackery Tyndall if any of the revenues generated by the proposed property tax rate of 80 cents per $100 of would go toward the reserves. Tyndall replied that if FY21 balances close out as projected there will be funding for the reserves, but allocations have not been established for FY22.

The reserve fund balances are not budgeted. Rather, they are goals to work toward.

Saleh said the reserves are good to have in place, so the town does not have to rely on a tax increase or cutting capital improvement projects. Tyndall added that the town needs to increase funding in disaster recovery and capital reserves to react to a drastic event if one occurs.

Although the reserve policy could be one sentence, Fleetwood explained that the three-page version proposed allows the council to have more control of the reserves.

Purnell argued that adopting reserves would be an additional expenditure in the budget, but Saleh said I depends on the council’s approach.

“If you want to be more proactive and going forward faster, you would be setting up a goal within a certain amount of time and then budget for that to be as a projection to have the balance completed,” she said.

For the town to obtain its goal, it could take several years. The council could plan to see how to reach those goals, but an expense does not necessarily need to be created on the next year’s budget, Saleh said.

“Understood, but if we want to obtain those goals, we’re going to have to put more money aside then what we’re currently doing,” Purnell said.

Furthermore, slot revenues could go toward the reserve goals.

Tyndall said the short-term goal for the council is to create the stabilization reserve benchmarked for $1.1. million at this time.

A formal motion was required to move forward with the reserve policy, but the councilmembers agreed to wait to vote until a final version of the reserve policy was presented at an upcoming meeting.