JOSH DAVIS/BAYSIDE GAZETTE

Members of the Berlin Town Council last Thursday start fiscal 2020 budget deliberations during a public meeting at Town Hall. The bulk of the meeting was discussion of the need to raise property taxes and some utility fees in order to offset recent overages.

PHOTO FROM MEETING PACKET

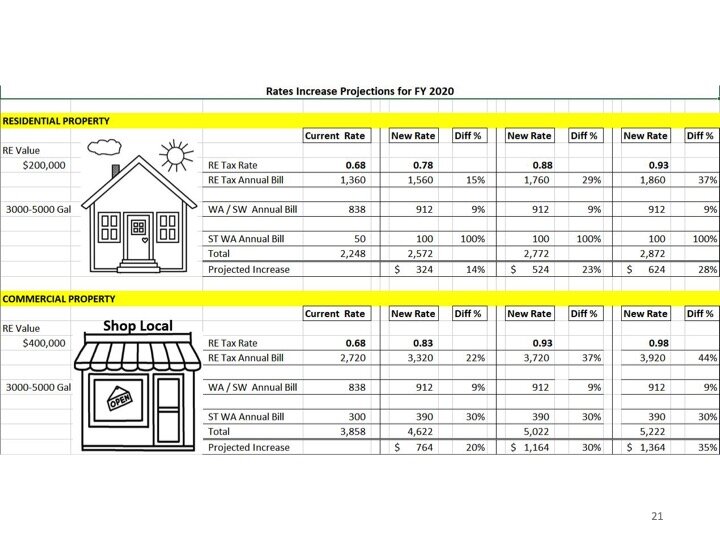

Town of Berlin models show how much residents and business owners could pay if proposed new property tax and utility fee increases are approved.

By Josh Davis, Associate Editor

(Feb. 28, 2019) Town of Berlin budget work sessions for fiscal 2020 began last Thursday with rate increase recommendations for utility fees and property taxes, with the latter possibly going up by a third or more.

Stormwater fees are recommended to double for residents – from $50 annually to $100 – and increase 30 percent for commercial property owners, who are charged based on square feet of impervious surface. Water and sewer fees look to increase 9 percent next year.

Residential and commercial property taxes, meanwhile, could rise anywhere from 5 cents per $100 of evaluation, to more than 25 cents.

Slides presented during the meeting showed the combined impact on residential homes valued at $200,000 and commercial properties valued at $400,000.

Of the five options shown “Option 3,” for example, would see annual payments for property taxes, water and sewer, and stormwater combine to rise $324 per year, assuming a 14-percent residential property tax hike. Under “Option 5,” residential property tax rates would increase 28 percent and total costs would go up $624 for a $200,000 home.

In similar models for commercial properties, a 20-percent property tax increase, in this case also “Option 3,” would cost business owners $764 more per year, while the 35 percent “Option 5” rate increase would cost $1,364 more annually for a business valued at $400,000.

Mayor Gee Williams, during his opening remarks, said the town must balance its short-term needs and long-term goals.

He said adjustments to the utility fee structure and tax rates “must be made to first increase and then set a minimum level to support the town’s unrestricted general fund balance.”

He said the current unrestricted general fund balance, or reserves, was $3.7 million, “which equals about five months worth of town operating expenses.”

Town reserves during the last several years have decreased from a high of $9.9 million in 2015, because the town borrowed from reserves to cover utility fund losses.

“Over the past eight years, the sewer fund has borrowed over $3 million from the general fund to cover operating expenses, while during the last four years stormwater has borrowed about $250,000 from Berlin’s general fund,” Williams said. “Utility fees charged for these funds must be increased to generate enough cashflow to stop the borrowing … and over time pay back the loans from the general fund. Even with modest sewer and stormwater fee increases, this repayment cannot be accomplished in just one or two years.”

Property taxes also must be addressed, he said. According to a chart shown of current charges, the Berlin rate of $0.68 per $100 of valuation is the second lowest in Worcester County, higher only than Ocean City’s $0.47 rate.

The current county rate is $0.84 and the rate in both Snow Hill and Pocomoke is $0.98. Increased rates in Berlin ranged, in several models, from $0.73 to $0.93 for residential homes, and from $0.78 to as much as $0.98 for commercial properties.

Williams said the town also must keep an eye on a parking study due later this year, as well as find ways to recapture some revenue from economic growth to cover the increasing demands on town infrastructure.

“The private business sector directly benefits from the town’s ongoing investments in both infrastructure and economic development,” he said. “I’ve long maintained that town residents should not have to underwrite those town investments that are necessary for sustaining and enhancing economic growth in the private sector. I also believe the mayor and council should do everything within our influence and means to ensure that Berlin’s economic resurgence is sustainable and does not become just a short-lived flash in the plan.”

Williams said he hoped residents would “ultimately conclude that private sector business growth is a benefit to the town financially,” adding “the right places for [commercial] development,” in his opinion, were along the Routes 50 and 113, as well as on Ocean City Boulevard.

“All in all, I believe if we realistically address the property tax, and sewer, water and stormwater rates for the short term, while also … [continuing] to make our community more economically stable and strong, we’ll be on the right track,” Williams said. “The Town of Berlin will then continue on a path of improving our quality of life, while balancing current and future needs within our economic means.”

Williams later said he was recommending no payroll increase this year, adding, “If we’re going to spread it among our taxpayers and fee payers, we also need to spread it among everybody, including our employees.”

Town Administrator Laura Allen said she was recommending no additions to the Berlin workforce.

Faced with several options on property taxes, Town Councilman Troy Purnell said he favored “Option 4,” or increasing residential rates to $0.88 and commercial rates to $0.93. He said that could be balanced to an overall rate of $0.91. According to one model, the roughly 30 percent upsurge could yield an additional $855,509 in revenue each year.

“We waited too long to do this, and that’s the bottom line,” Purnell said of the overall need to raise rates. “We have got the nicest sewer system in the state, but we had to pay for it … this whole time we’ve been losing money on it every year, and it keeps getting worse and worse.”

Purnell said taxes in the town had not been increased in some time, and that no one could have anticipated the infrastructure needs associated with the town’s recent success. He added of the erosion to reserves, “This is the year it’s gotta stop.”

Councilman Dean Burrell said he favored increasing the residential rate to $0.88, but raising the commercial rate to $0.98.

Burrell, earlier during the meeting, said the latest audited financial report was “one of the things that [brought] us here.” The PKS & Company annual report, delivered publicly in December, showed town reserves decreased by $1.8 million during the last fiscal year.

“If we have a department that’s operating at a deficit because of a rate structure, it would be negligent of us to not try to correct that at this point,” he said.

Burrell added a reduction to town services was not being considered.

“Citizen expectation of service is paramount,” he said. “We don’t want to cut the quality of services that folks here in the Town of Berlin have become accustomed to.”

Councilman Zack Tyndall asked for a comparison on a $0.91 rate for both residential and commercial properties, measured against a split rate of $0.88 and $0.98 prior to meeting again.

A general fund work session was scheduled on April 1, and a utility fund session was set for April 15.